Nepal's New Monetary Policy: What It Means for Your Loans, Savings, and Business

By Economics Nepal ·

Every year, Nepal Rastra Bank (NRB), the nation's central bank, unveils its Monetary Policy. While it might sound like a document for bankers and economists, its impact is felt by every single Nepali. It's the master plan that determines how expensive it is to get a loan for a new home, how much you earn on your savings, and how easy it is for businesses to grow. Think of it as the NRB's strategy to keep our economy healthy and moving forward.

This year's policy for Fiscal Year 2082/83 (2025/26 AD) can be summed up in two words: **"cautiously flexible."** This isn't just jargon; it's a promise. It means the NRB is carefully loosening its grip to encourage spending and investment, while keeping a watchful eye on any risks that could threaten our financial stability.

Let's break down what this "cautiously flexible" approach means for you.

#### **The Economic Big Picture: A Tale of Two Realities**

To understand this year's policy, we need to look at our country's recent economic health report card. It shows a fascinating contrast: our national-level finances are strong, but many businesses and banks are facing challenges.

**The Good News: A Stable Foundation**

The "flexible" part of the policy is possible thanks to some big wins for Nepal's economy:

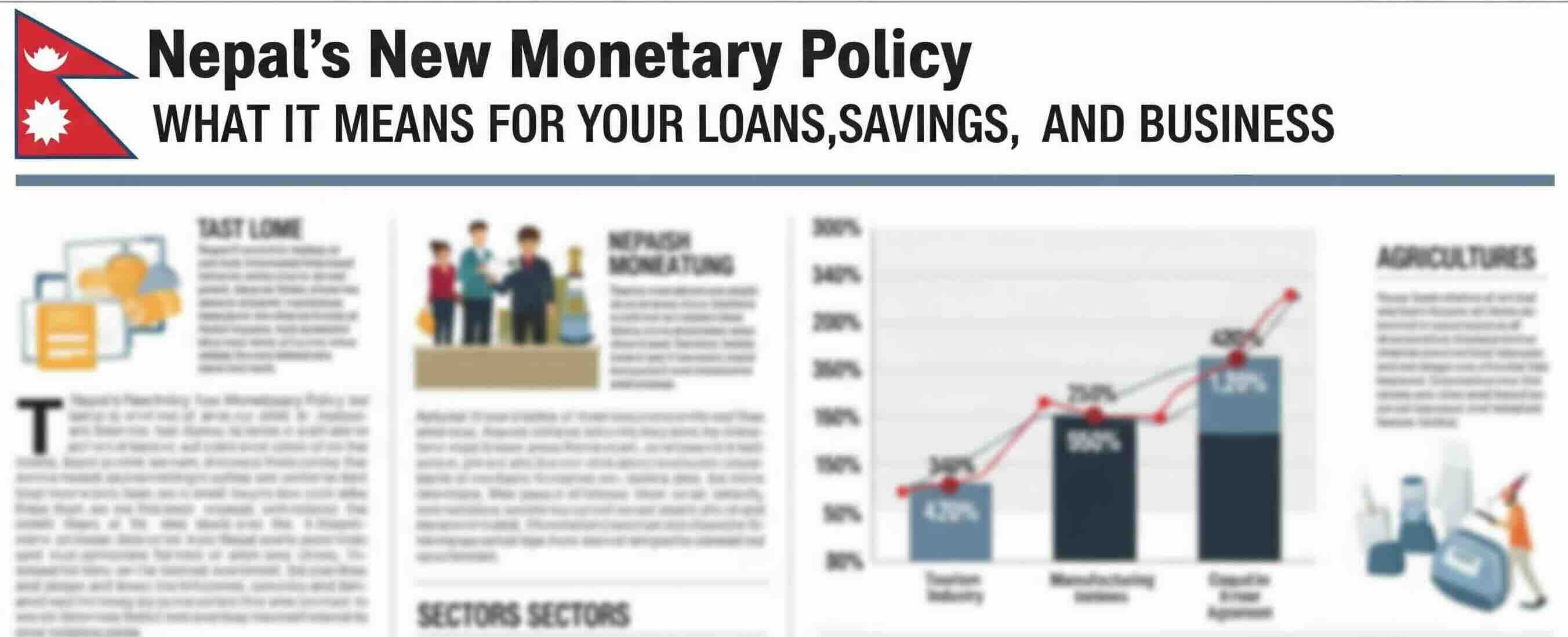

* **Inflation is Tamed:** The NRB's goal was to keep inflation under 5%, and they succeeded. Over the first eleven months of the last fiscal year, average inflation was just 4.24%. By the end of Jestha 2082, it had dropped to a very low 2.72%. This means the prices of everyday goods are not rising uncontrollably, giving the NRB room to boost the economy without fearing a sudden price spike.

* **Foreign Money is Pouring In:** Our foreign exchange reserves are incredibly strong. We now have enough to cover **14.7 months** of imports, more than double the target of seven months. This stability, driven by remittances, tourism, and exports, protects our economy from external shocks.

* **The Economy is Growing Again:** After a slowdown, the economy is projected to grow by 4.61% for FY 2081/82, up from 3.67% the previous year. Key sectors like manufacturing and construction, which had been struggling, are finally expanding.

**The Bad News: Caution is Still Needed**

The "cautious" side of the policy comes from real problems that are still bubbling under the surface:

* **More Bad Loans:** The percentage of Non-Performing Loans (NPLs)—loans that are at high risk of not being paid back—has been rising. It reached 5.24% by the end of Chaitra 2081. When banks have too many bad loans, they become hesitant to lend out more money, which slows down the economy.

* **Businesses Aren't Borrowing:** Here's the puzzle: even though banks have plenty of cash and interest rates are falling, businesses are not taking out loans as much as expected. This suggests a lack of confidence and a shortage of new investment ideas.

The new monetary policy is designed to use the good news (stability) to fix the bad news (sluggish investment).

#### **The Headline Change: Cheaper Loans for Everyone**

The most direct action from the NRB is a clear signal: the cost of borrowing money is going down. The central bank has cut its main interest rates, a move designed to make loans cheaper across the entire country.

Here's a look at the key changes:

| Policy Rate | What It Is | Old Rate | **New Rate** |

| :--- | :--- | :--- | :--- |

| **Policy Rate** | The main signaling rate for the economy. | 5.0% | **4.5%** |

| **Bank Rate** | The rate at which banks borrow from NRB in emergencies. | 6.5% | **6.0%** |

| **Deposit Collection Rate** | The rate banks get for parking excess cash with NRB. | 3.0% | **2.75%** |

By lowering these rates, the NRB is making it cheaper for banks to get funds and less attractive for them to just sit on cash. The goal is to encourage them to do what they do best: lend money to people and businesses who will use it to build, buy, and invest.

#### **Targeted Support: What the New Rules Mean for You**

Beyond the big rate cuts, the policy includes specific changes for different groups.

**For Home Buyers:**

Good news if you're looking to buy or build a home. The NRB has made it significantly easier to get a home loan.

* **Bigger Loans:** The maximum loan you can take for a private home has been increased by 50%, from Rs. 2 crore to **Rs. 3 crore**.

* **Easier Financing:** For **first-time homebuyers**, banks can now finance up to **80%** of the property's value. For others, the limit is **70%**. This means you'll need a smaller down payment.

**For Stock Market Investors:**

The stock market is also getting a boost.

* **Massive Increase in Margin Loans:** The limit for loans against shares has been raised by over 66%, from Rs. 15 crore to **Rs. 25 crore**. This allows bigger investors to put more money into the market.

* **Cheaper for Banks to Lend:** The "risk weight" on these loans has been lowered from 125% to **100%**, making it more profitable for banks to offer them.

**For Business Owners (Especially SMEs and Farmers):**

The policy focuses heavily on supporting the backbone of our economy.

| Initiative | Who It's For | What's Changing |

| :--- | :--- | :--- |

| **Simplified Agri-Loan** | Small farmers | Loans up to **Rs. 10 lakh** can be given with simpler collateral checks, like just looking at crops and land. |

| **Highway Business Boost** | Hotels and industries along major highways | Loans up to **Rs. 3 crore** will have their interest rate capped at a low premium over the base rate. |

| **Earthquake Relief** | Borrowers in affected areas | Easier terms to restructure loans by paying just 10% of the outstanding interest. |

The controversial Working Capital Loan Guideline will also be revised to be more practical for different types of businesses.

**For Microfinance Clients and Nepalis Working Abroad:**

* **Easier Loans for Foreign Employment:** A new loan product allows individuals to borrow up to **Rs. 3 lakh (for men)** and **Rs. 5 lakh (for women)** to cover the costs of going abroad for work, even without collateral.

* **Microfinance Dividend Review:** The 15% cap on dividends distributed by microfinance institutions will be reviewed, which could attract more investment into the sector.

#### **Building a Stronger Financial System for Tomorrow**

This policy isn't just about short-term fixes. It lays the groundwork for a modern, resilient financial future.

1. **A "Bad Bank" to Clean Up the Mess:** The NRB plans to create an **Asset Management Company (AMC)**. This is essentially a "bad bank" that will buy up the non-performing loans from commercial banks. This allows banks to clean their books and focus on fresh, productive lending, while the AMC specializes in recovering the bad debt.

2. **The Rise of Digital 'Neo Banks':** The policy is preparing for the future by creating a legal framework for **'Neo Banks'**—banks that are entirely digital, with no physical branches. This move aims to expand financial access and make banking cheaper and more efficient for everyone through technology.

#### **A Calculated Push for Growth**

The Monetary Policy for 2082/83 uses our strong national economic position as a launchpad to tackle the weaknesses holding us back at the ground level.

The message is clear: money is now cheaper, and there is targeted support for key sectors like housing, stocks, and small businesses. But this is not a reckless dash for growth. The "cautious" approach, especially the plan to create a "bad bank," shows a serious commitment to fixing underlying problems.

Ultimately, the NRB has opened the door for a new wave of economic activity.

Share this article:

Published by Economics Nepal

© 2024 All rights reserved